Features & Benefits

Key Points

- Add-On Card has the same features as that of the Primary Credit Card.

- Add-On Card will be issued only to family members having an existing relation with the Bank.

- It can only be availed via Credit Card Tab in FedMobile.

- Credit Limit of the Primary Cardholder will be shared with the Add-On card customer. (up to Maximum available limit)

- Up to 4 Add-On cards can be availed. Applicable Charges: ₹100 + GST per card.

- Only Primary holder can activate & enable/disable card controls of the Add-On Card (either via FedMobile or IVR).

- Add on card will be delivered to the registered address of the add on customer.

- OTP for Add-On Card transactions initiated with the Add-On card will be sent to the registered Mobile Number of Add-On Card holder.

- The Primary Credit Card holder is liable for all spends and transactions done by Add-On Credit Card holder, and such spends will be part of the Primary Credit Card holder’s monthly statement/Bill.

How to Apply

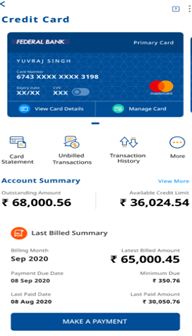

To avail Add-On card for your beloved ones, go to FedMobile App >> Credit Cards.

Terms & Conditions

| Terms & Conditions for Add-on Cards | Click here to view |

| General Terms & Conditions - English | Click here to view |

| General Terms & Conditions - Hindi | Click here to view |

| General Terms & Conditions - Malayalam | Click here to view |

| Most Important Terms & Conditions - English | Click here to view |

| Most Important Terms & Conditions- Hindi | Click here to view |

| Most Important Terms & Conditions - Malayalam | Click here to view |

| Amazon Gift Card Terms & Conditions | Click here to view |

| BigBasket offer Terms & Conditions | Click here to view |

| Inox Offer Terms & Conditions | Click here to view |

| Airport Lounge Offer Terms & Conditions | Click here to view |

| Credit Card EMI Terms & Conditions | Click here to view |

How to Apply

As a primary cardholder, Credit Card holder can request an add-on card for their family members having an existing relation with Federal Bank.

Steps to apply for Add-on card

|

|

Login to FedMobile: Customer to go to Credit Card section and click on “More” tab.

|

|

|

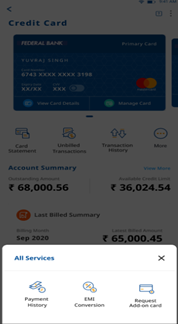

Request for Add-on Card: Customers to click on Request Add-on Card on the pop-up menu.

|

|

|

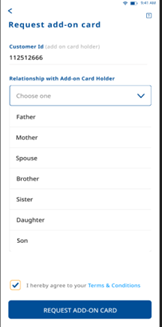

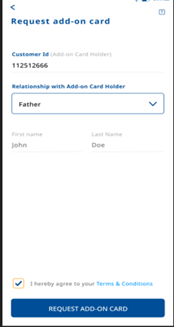

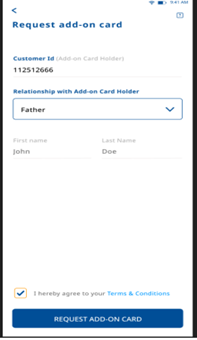

Enter details for Secondary Cardholder: Customers to enter the customer id for add on card holder and the relationship with the secondary cardholder.

|

|

|

Accept TnC: Customers to accept the Terms and Conditions by checking the box and then submitting the request by clicking on “Request Add-on Card”.

|

|

|

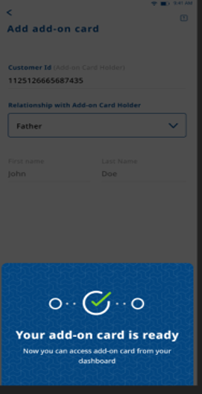

Add on Card is ready: Customer request for Add on Card is successfully processed. Primary cardholder can access add on card from the dashboard screen. The card will be delivered to the Primary card holder’s address (where the primary card was delivered).

|

Frequently Asked Questions

What is the Eligibility Criteria for a Add-On Card?

Add-On cards can be applied by a Federal Bank Credit Cardholder for his family members.

How many Add-On Credit Cards can be availed at a time?

Maximum of four Add-On Cards are allowed per Credit Cardholder.

What are the charges for Add-On Cards?

Issuance Charges per Add-on Card: ₹100 + GST

Does Add-On cards earn Reward points?

Yes. Spends done on Add-on Credit Card will also accumulate reward points as per the product reward points structure and will reside in Add on Card holder’s account.

What will be credit limit for Add-On cards?

Single shared credit limit will be set against the Primary Credit Card and Add-on Credit Cards. Add-on Credit Card transaction limit is set at the discretion of Primary Credit Card holder which can be upto the maximum credit limit allowed on Primary Credit Card.

Are there welcome offers for Add-On Cards?

Add-on Credit Card holder will not get benefits/offers such as Welcome vouchers, Wellness pass/Swiggy/Big Basket vouchers or any memberships which are part of the Primary Card’s value proposition except for lounge access, INOX BOGO, and Network Offers which are limited to maximum value available for Primary Credit Card in aggregate.

How can I manage Add-On Cards?

The Primary Cardholder can manage the Add-on Credit Card transactions and card controls using the FedMobile app. This can also be done via IVR using primary Cardholder’s registered mobile number.