Stay Informed, Stay Smart

You might be interested

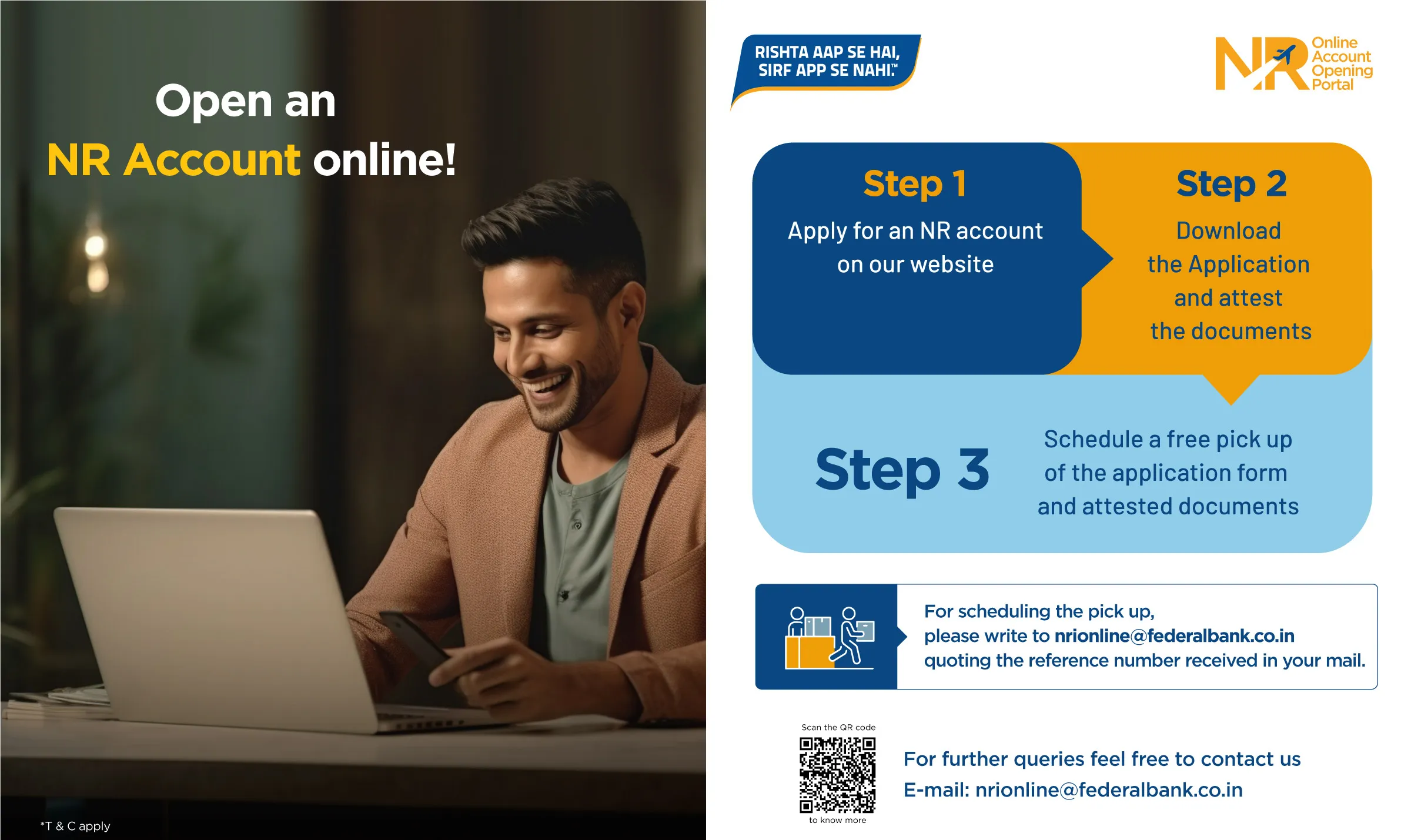

Recommendations for a safe and easy banking experience

Tutorial Videos

Watch tutorial videos about our products & services and harness the power of digital banking.

Learn More