Making a Mark

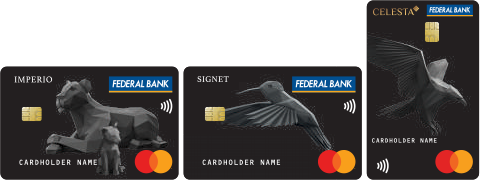

Our Credit Card, launched for the internal CUG Team in March 2021, is India’s first-of-its-kind complete digital card. The card, which we have since expanded to cater to our existing customers, is issued and activated through a 3-click process. The virtual card is delivered to the applicant through FedMobile within seconds, followed by physical card.

FEDDY gets ‘cooler’

We added some more cool features during the pandemic to Feddy, our AI-powered Virtual Personal Assistant. Feddy is equipped with state-of-the-art machine learning algorithms to answer all banking queries of customers on the go, 24x7. Accessible via Alexa, Google Assistant, Corporate Website and WhatsApp, Feddy can also be searched through Google Maps and Google Search. Besides providing a host of bank-related information, Feddy also has a lighter side to it – it is always ready to cheer up the customer with a joke or two. All you need to do is ask!

And there’s more…

Besides Feddy, Federal Bank’s digital sweep encompasses many other unique initiatives, including facial recognition for employees, blockchain technology-based solutions for remittances, video-based KYC solutions. Equipped with more user-friendly and advanced features, our revamped FedMobile provided end-to-end solution to customers during these pandemic times.

During FY 2020-21, we also upgraded various digital platforms, such as FedNet, Lotza and FedBook (for retail customers); FedCorp, Corporate FedNet, Paylite and Fed-E-Biz (for corporate and SME customers). These upgradations led to enhanced experience and security for our customers.

Our pioneering GoNoGo solution allows Tab Banking for auto loans.

In keeping with its mantra of ‘Digital at the fore, Human at the core’, the Bank has ensured that customers who needed to visit the Bank personally, amid COVID-related curbs, did not have to wait outside for their turn. FedSwagat allows them to secure a web appointment, with the reference number delivered via SMS facility.

We are enhancing our investments in API banking, working closely with our existing and new Fintech partners to give an enhanced digital experience to our customers. With IT emerging as an enabler to make the Bank more digitally empowered, we are also moving some of our apps to Cloud architecture. We have set up a Centre of Excellence for RPA (Robotic Process Automation) transformations to boost ease of transactions and enable better engagement for customers.

With the pandemic necessitating new ways of marketing, we are now promoting our products through an array of engaging digital and social media campaigns, while also using traditional avenues such as Radio Campaigns for certain products like Gold Loans.