Driving Social Empowerment

Our social enterprise involves working towards community stakeholders through initiatives aligned with the United Nations’ Sustainable Development Goals (SDGs).

Social Initiatives

Description and Highlights

UN SDGs Impacted

Financial Literacy

The Bank has launched various schemes for imparting financial literacy through rural branches and financial literacy centres.

During FY 2020-21, 507 financial literacy camps (including 270 online sessions) and 205 counselling sessions (including tele counselling) were undertaken through Federal Ashwas Financial Literacy Centres. Around 0.15 Lakh participants benefited from the initiative.

Social Security Schemes

Pradhan Mantri Jan Dhan Yojana (PMJDY): The number of total enrolments is 6.20 Lakh, as on March 31, 2021.

PMJJY: The number of total enrolments is 1.49 Lakh, as on March 31, 2021.

PMSBY: The number of total enrolments is 3.74 Lakh as on March 31, 2021.

Government Sponsored Credit Schemes

The Government of India and various State Governments have come up with several credit schemes with and without subsidy. The major Government sponsored schemes implemented by the Bank are as follows:

Pradhan Mantri Mudra Yojana (PMMY): The number of loans sanctioned under Shishu, Kishore and Tarun has reached 4,602 accounts, totalling an amount of ₹ 10,658.58 Lakh, as on March 31, 2021.

Prime Minister’s Employment Generation Programme (PMEGP): TThe number of loans sanctioned under PMEGP was 2,790, and the amount sanctioned was ₹ 6,420.36 Lakh, as on March 31, 2021.

National Rural Livelihoods Mission (NRLM): The number of loans sanctioned under NRLM has reached 140, and the amount sanctioned was ₹ 281.20 Lakh, as on March 31, 2021.

National Urban Livelihoods Mission (NULM): The number of loans sanctioned under NULM reached 208 and the amount sanctioned was ₹ 242.13 Lakh, as on March 31, 2021.

PM Street Vendor’s Atmanirbhar Nidhi (PM SVANidhi): The number of loans sanctioned under the scheme reached 896, and the amount sanctioned was ₹ 89.55 Lakh, as on March 31, 2021.

Chief Minister’s Helping Hand Loan Scheme (CMHLS): The number of loans sanctioned under the scheme has reached 1,438 and the amount sanctioned was ₹ 1,331.24 Lakh, as on March 31, 2021

Employee Welfare and Development initiatives

Equal opportunity, diversity and inclusion

Our Talent acquisition process involves visiting various reputed institutions in different states across the country.

During the last recruitment process, over 40% of candidates hired were women, which aligns well with our Gender Diversity Philosophy. Of the 1,265 general banking branches, 20% of branches are headed by women.

Employee Welfare

- Fully paid maternity leave & paternity leave

- Fed Cradle - concessional crèche facility

- Education scholarship to employee’s children

- ssLFC, including foreign travel

- Compassionate appointment - in the unfortunate event of death of an employee

- Sabbatical leave

Employee Well-Being

- Financial Wellness - Staff loans with attractive rates of interest; 1% additional interest rate on deposits

- SMILES - dedicated hotline for counselling sessions by trained professionals

- Medical Insurance scheme coverage for employees and dependent family members

- Annual health check-ups for employees aged above 40, along with spouse

- Wellness programmes/campaigns through tie-ups with hospitals and other organisations

- Exclusive medical welfare trusts for catering to the medical needs of employees

- Annual medical aid to employees for investing in well-being

DIYA: Diya is a welfare scheme to support the immediate financial needs of the family suffering from the unfortunate loss of an employee.

Care for retired employees: The Bank offers retirement planning programme -Odyssey - to employees who are about to retire from service. This helps them organise their financials like tax planning, and also includes sessions on yoga and meditation for health and well-being. Dedicated ID Cards and service memoir, medical insurance is also provided by the Bank.

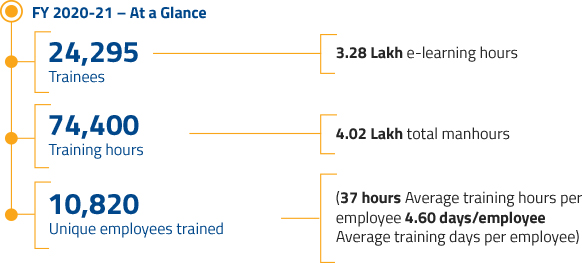

Overview of Learning and Development

Caring During COVID-19

A COVID-19 Help Desk was set up at zone/regions to take care of employee needs and immediate priorities in specific zones, regions and Head Office, with dedicated lines. Crisis Management Teams were formed at Head Office and all Zonal Offices. The team had discussions on Business and People Continuity front and designed weekly COVID management strategies. Bank gave autonomy to Zonal leaders to take decisions on matters pertaining to their locality, depending on the local requirements/adhering to the local guidelines. This drastically cut down the time in taking crucial decisions, thus expediting the activities in their respective zones. Bank gave special consideration to employees who needed special care, such as seniors, women employees who are expecting mothers, and employees with challenging health issues.

Being Progressive with Evolving Needs

The health and safety of the employees and their families have been the Bank’s top priority throughout the pandemic.

- COVID Assistance Programme

- Limited Employee Movement

- Special Casual Leave

- Doctor on Call

- Webinar on Meditation, Yoga

- Interactive Talk Show on Health Risks of the Employees

- Webinar on Diet & Nutrition

- Extended Out-of-Pocket expenses

- Medical Insurance coverage in connection with COVID-19

- Reimbursement of Travelling Expenses