THRIVING WITH SHARP DIGITAL EDGE

In today’s banking landscape, the modern banking customer is actively seeking an enhanced digital experience. In order to thrive in the digital age, banks are constantly pushing the boundaries to identify innovative ways to distinguish themselves and provide a compelling value proposition, while maintaining a human touch. Banks that have effectively harnessed the power of technology are capable of operating on a larger scale, while consistently surpassing customer expectations through ongoing innovation of their services and offerings.

At Federal Bank, we have always been a step ahead in providing an unmatched customer experience, whether through our branches or in the digital space. Federal Bank leverages the latest technologies such as artificial intelligence, machine learning, blockchain and biometric capabilities to gain faster and deeper insights as a bank of tomorrow. This enables us to be agile in our approach and offer a personalised experience. We successfully navigate the digital landscape by embracing cutting-edge technologies and nurturing genuine connections with customers.

As part of our evolved digital strategy, Federal Bank aims to redefine the customer experience by implementing the following measures:

Embracing Open Banking through the use of Application Programming Interfaces (APIs)

Collaborating with FinTech companies to expand the scope of banking services

Providing digital loans and credit cards through strategic partnerships

Prioritising the use of cloud-based technology for a wide range of product offerings

Implementing Robotic Process Automation (RPA) across various product categories

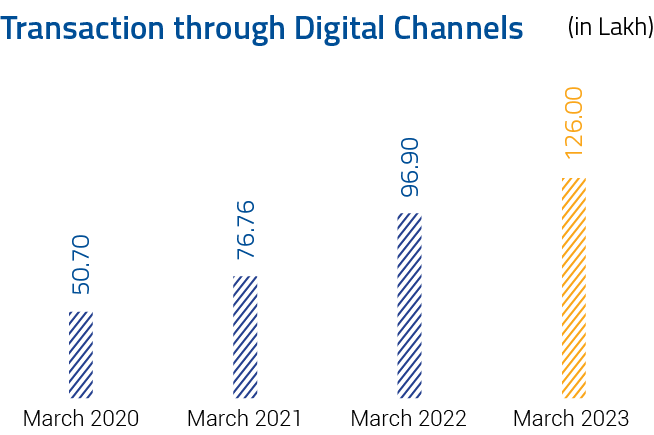

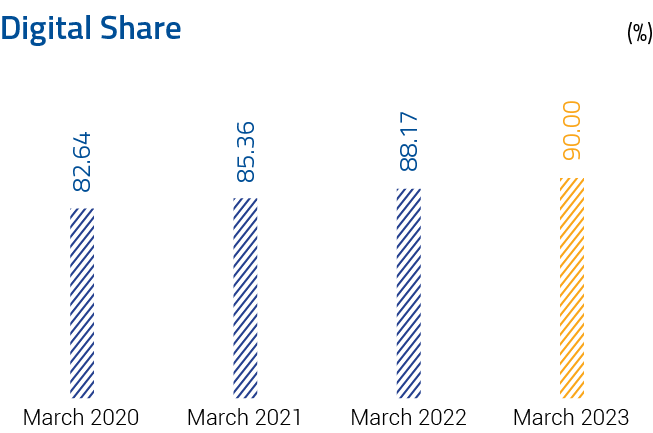

Through innovation and class leading products that include mobile banking offerings, omni-channel transaction banking solutions, 24x7 digital service availability and a lot more, Federal Bank has evolved into a Bank with a Digital Edge.

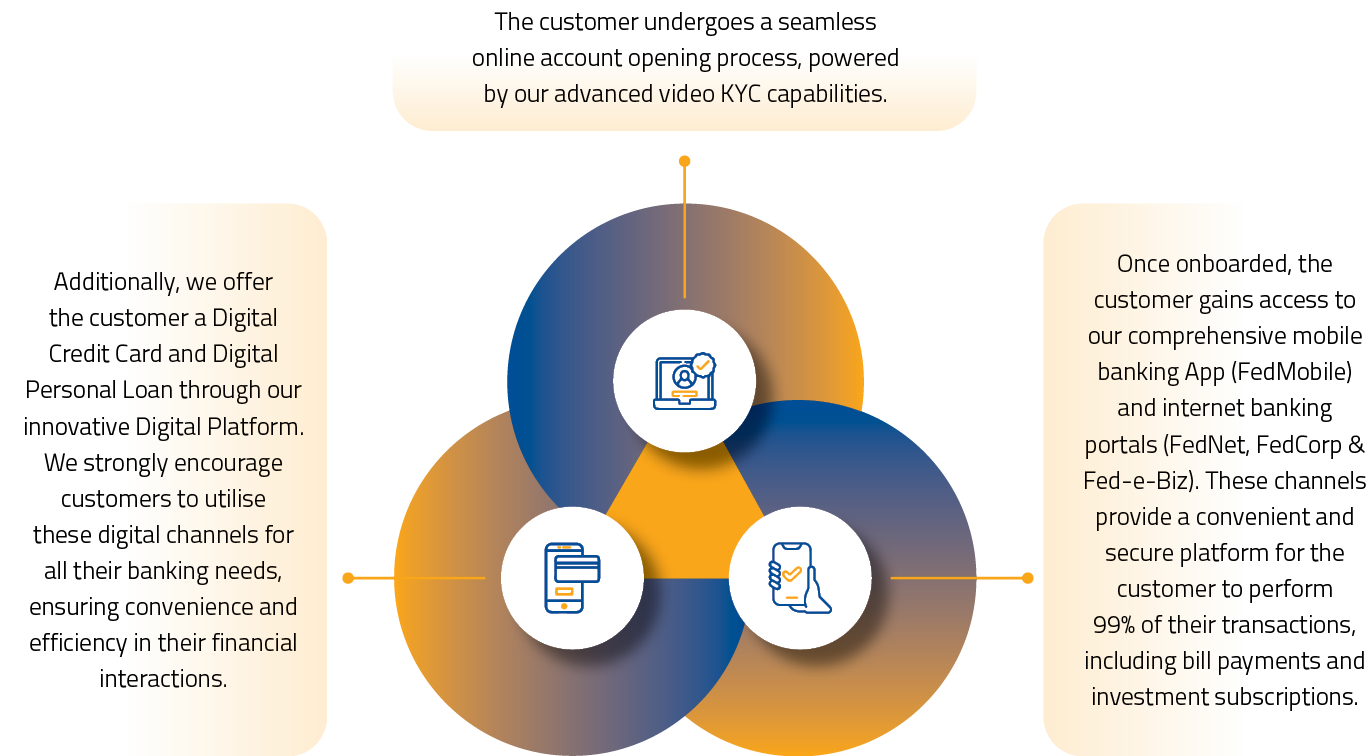

The Digital Customer Life Cycle

Our range of digital solutions is designed to address the unique requirements and preferences of various customer segments throughout their life cycle. Some of our innovative offerings are outlined in the table below.

| Product/Service | Description |

|---|---|

| Point of Sale (POS)/Payment Gateway (PG)/Quick Response (QR) | Digital infrastructure for meeting the payments and acceptance needs of customers |

| Fed-e-Biz | Transaction banking platform for corporate and SME clients, powered by state-of-the-art technology |

| Careerbook | Fee management solution for educational institutions, handling student fee collection and internal management |

| BankOnTheGo | Vehicles wherein the banking facilities are taken to the doorsteps of customers |

| FedGold@Home | Doorstep gold loan facilities to the customers through banking correspondents ensuring an end-to-end digital journey for loan processing, disbursement and collection |

| Digital Kisan Credit Card (Digital KCC) | End-to-end digital journey is ensured for assessment, documentation and disbursal of the loan, offered to farmers |

| Cross-border BBPS system | Payment solutions for utility bills aimed at Non-Resident customers from abroad |

| FedMi | Microlending through banking correspondents for customers belonging to the micro-category, featuring automated loan origination and loan management |

Digitally Ensuring Safety and Security

At Federal Bank, ensuring the safety and security of digital transactions and payment products is of supreme importance. We prioritise the implementation of robust measures and cutting-edge technologies to safeguard our customers’ interests through a range of Board-approved policies. These include the Information System Security Policy, Digital Payment Product and Services Policy, Fraud Risk Management Policy, Cyber Security Policy, and Operational Risk Management Policy. These policies serve as comprehensive guidelines for our development and product teams, outlining the necessary measures to be adopted to safeguard our customers’ interests.

Safety in Digital Products

The development and rollout of the digital products are done under proper testing and security checks. Our Bank also conducts comprehensive vulnerability assessments and penetration testing at regular intervals to ensure our applications’ utmost safety and security.

Security in Digital Transactions

At Federal Bank, we employ strong encryption for end-to-end security, ensuring that all digital transactions are protected against unauthorised access. Furthermore, we have implemented a robust 2-Factor Authentication mechanism to strengthen customer authentication.

Additionally, to stay ahead of evolving cyber threats, our Bank ensures continuous training for our officials. Regular sessions on cyber security aspects are conducted, equipping the team with the necessary knowledge and steps to combat and prevent cyberattacks.

Feddy at your Service

Feddy is our AI-based virtual personal assistant. An omnichannel platform, it has been at the forefront of seamlessly resolving customer queries with efficiency.

Feddy's role has undergone a systematic evolution since its inception. Initially, it primarily served as a reliable resource for answering general inquiries, related to banking products, specific to our Bank. However, Feddy has now advanced to a level where it can efficiently handle customer-specific queries, offering real-time responses to inquiries such as checking the account balance. This allows for a more personalised and efficient customer experience, empowering individuals to access relevant information promptly and conveniently.

Furthermore, to ensure utmost customer satisfaction, we have incorporated a 24 X 7 live agent chat facility on channels such as Whatsapp, Google Maps + Search , Bank’s Corporate Website as an extension to the Chatbot service. If a customer finds the responses provided by Feddy unsatisfactory or if Feddy is unable to answer a specific query, the customer is seamlessly connected to a live agent for personalised assistance. This integration of human support with the convenience of automated service ensures that our customers receive the best of both worlds.