Amplifying Brand Prominence for Stronger Connections

At Federal Bank, we believe in engaging with our customers in a meaningful way by creating a banking experience that resonates with them. Their satisfaction and success are at the heart of everything we do. Through our journey of excellence, we intend to power the brand ‘Federal’ identity to go from Presence to Prominence and from Prominence to Dominance. Through our marketing initiatives we strive to hyper-accentuate the ‘Federal’ brand across the country. We build further on our Bank’s philosophy that revolves around the distinctive 3S structure, representing the segment-centric, scalable and sustainable nature of our initiatives.

Segment

|

Scale

|

Sustainable

Micro: Retail

ESG: Environment,

Social & Governance

IAAS TM : Corporates

CSR: Communities

Serving भारतwith India’s TrustTM

We evaluate every idea by asking ourselves three integral questions.

With a lens of this kind, we can’t help but be conscious of the need to create initiatives that are run all around the year across various spectrum, including retail and corporate customer segments.

As we forge a stronger future ahead, we take pride in our young teams who have a pulse on the next generation of customers and are focussed to serve their evolving needs. The digital platforms developed through our Digital Centre of Excellence are arguably top of the charts and have redefined the new-age customer’s experience. On the other hand, our long-term clients find the personal touch irreplaceable. After all, there is no parity between two individuals working in banking - they are unique, and human empathy is unmistakable.

Amidst the digital transformation we are witnessing all around, we remain committed to ensuring our digital prowess is sufficiently complemented by our efforts to maintain lasting relationships, that form the foundation of Federal Bank.

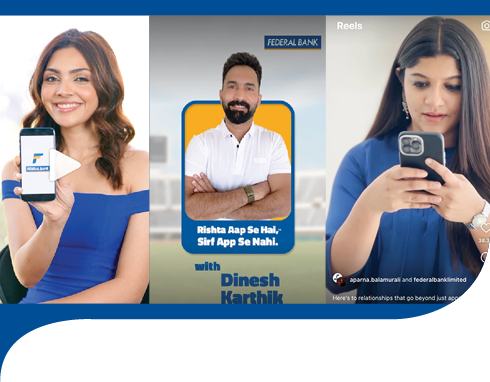

At the forefront of our marketing strategy this year was the highly impactful ‘Rishta Aap Se Hai, Sirf App Se Nahi TM’ brand campaign. With the objective of bringing alive our core work ethic, ‘Digital at the Fore, Human at the Core’, the Rishta campaign aimed to exemplify the value we place on building lasting relationships with our customers.

This campaign embodies a two-pronged approach, aiming to enhance our appeal and relevance to younger customers, while simultaneously nurturing the existing relationships that have been a pillar of our Bank’s enduring success. Our efforts have been aligned with our desire to demystify the banking experience and make it more approachable for all. By showcasing the importance of personal touch and human interaction in conjunction with our digital capabilities, we sought to reinforce our commitment to providing a holistic banking experience that combines convenience, innovation, and a warm personal touch.

Over a period of three months, this campaign was heavily promoted across numerous media channels that strategically complement each other. The brand campaign triggered multiple activities amongst the employees and customers, turning it into a 3600 campaign, resonating with the commitment of Federal Bank.

Activity

01

Federal Standard

Our branches were entrusted with the responsibility of creating the right first impressions and reflect the organisations’ branding through a rejuvenated look.

Activity

02

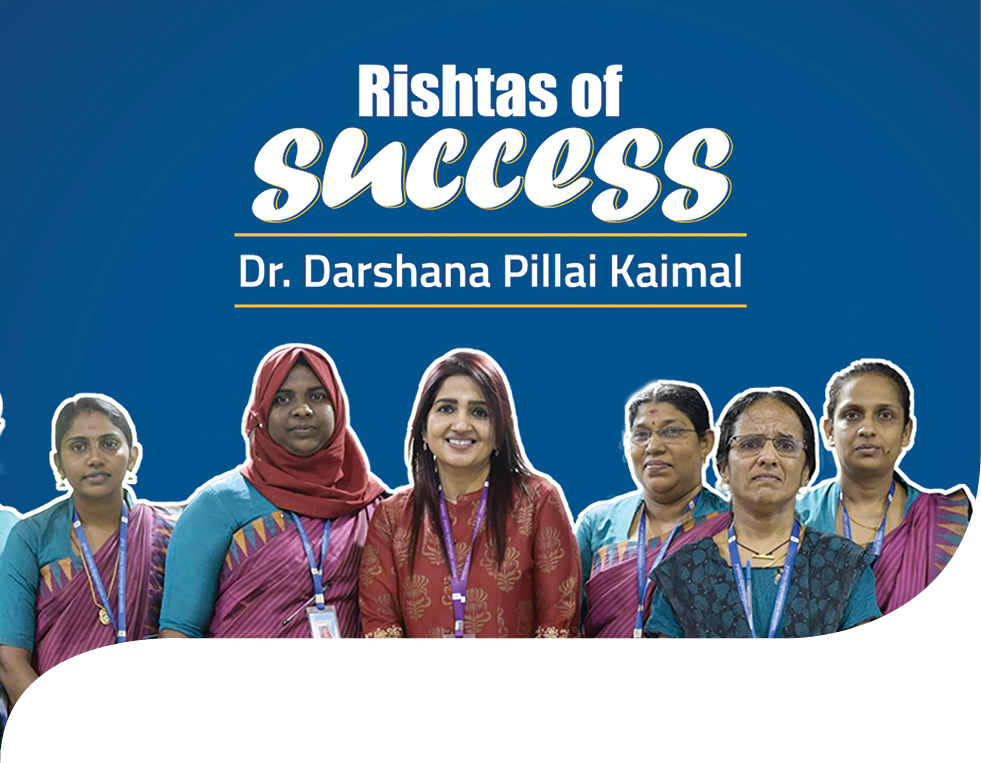

Employee Testimonials

Our employees were encouraged to share their experience working with Federal Bank and several employee engagement activities were conducted to boost morale.

Activity

03

Customer Testimonials

Our customers’ willingness to share their positive experiences with the brand served as a testament to the credibility we have established and the brand loyalty we have garnered over the years.

Activity

04

Celebrity Customers as Influencers

Our celebrity influencers across the country were happy to share the brand’s value and messaging, allowing us to communicate with newer audiences.

Activity

05

PR Stories

By crafting compelling narratives and messaging around the campaign, our PR stories have enabled us to capture the attention of journalists, bloggers and influencers and significantly enhance our media coverage.

Activity

06

Slice of Life Micro Films

Our multiple ‘slice of life’ micro films captured the beauty and meaning of the everyday moments of life.

At Federal Bank, we recognise the diversity of our wide customer base, and are committed to serving them all. With this in mind, we have made dedicated micro-marketing efforts to effectively communicate our Rishta campaign and celebrate our special relationship with each of our customer groups. Our goal is to foster a sense of inclusivity and personalisation, affirming our dedication to serving and enriching the lives of all our customers.

Some of our integral micro-marketing initiatives are listed below

Adyar Project

Rishta with Every Pin code

The Adyar project aims to celebrate the unique identity and culture of the Adyar neighbourhood in Chennai. The project aims to showcase the stories and experiences of local residents, businesses and organisations, thus creating a compelling narrative around what makes Adyar special.

Featuring a series of short videos, images and social media posts that capture the spirit and character of Adyar. This project celebrates the diverse people, rich history and vibrant traditions of the place.

Harnessing the Potential of Partnerships

Rishta to Power Entrepreneurial Growth

We have strategically collaborated with StartupTN (Government of Tamil Nadu’s nodal agency for startups and innovation) and MindEscapes (India’s premier thought-led innovation centre) to address the challenge that startups face in obtaining loans or investments to build a sustainable business. StartupTN identifies the startups, which then pitch their ideas through curated sessions facilitated by MindEscapes and supported by knowledge partners across the state. Federal Bank provides loans and grants to these startups, eliminating the hassles of fundraising.

Collateral free Loans, lower-cost loans and grants to eligible startups

Empowering startups with access to a network of industry experts and potential investors

Opportunity for startups to work on real-world projects and increase visibility

Federal Bank enshrined in a Hill of Flowers

Rishta to Better the Environment

In collaboration with Random Acts of Kindness Forum (RAOK), we initiated a project called ‘Hill of Flowers’ aimed at restoring the ecological balance and improving the air quality of the Nilgiris biosphere. The project is dedicated to creating mini miracles and uplifting the lives of the disadvantaged communities in and around the Nilgiris.

The ‘Hill of Flowers’ project involves the co-creation of a 1 km tract at Nilgiris, which is currently a bare hill. As a symbol of environmental stewardship, this project envisages the hill to be transformed into a picturesque and sustainable flower garden. It aims to utilise native plants, establish a food forest, and promote organic cultivation practices, using zero pesticide and chemicals, thus helping the plants to grow independently and sustainably.

Reinforcing our Brand Prominence

Festive Campaigns

To celebrate the cultural diversity of the country, we rolled out several campaigns to merge with the festive spirit and promote the ‘Federal’ Brand. Using Gold Loan and Car Loan products as an anchor strategy, we leveraged the network of several promotion channels to amplify our coverage.

Some of the festive campaigns that we rolled out across different geographies include:

Ganesh Chaturthi Campaign – Mumbai

Durga Puja Campaign – Kolkata

Navratri Campaign – Gujarat

Onam Campaign – Kerala

Diwali Campaign – Pan-India

NRI Campaign

The NRI campaign was launched with a special focus on Non Resident Keralites (NRKs) who were returning to Kerala after a two-year hiatus. To effectively engage with our target audience, we employed a multi-faceted approach that included film promotions in cinemas across Kerala as well as the use of innovative hoardings. In addition, we partnered with Red FM to launch a heart-warming activity in which the RJs visited the homes of NRKs to wish them a Happy Onam and recreate the warmth and nostalgia of the past.

Direct Tax Campaign

The ‘Direct Tax’ campaign was a targeted product campaign designed to raise awareness and promote our mandate to collect direct taxes on behalf of the Government. We executed this campaign through a combination of print and social media channels, reaching our intended audience with clear messaging and compelling visuals. This campaign reinforced our commitment to supporting the nation’s economic growth and development.

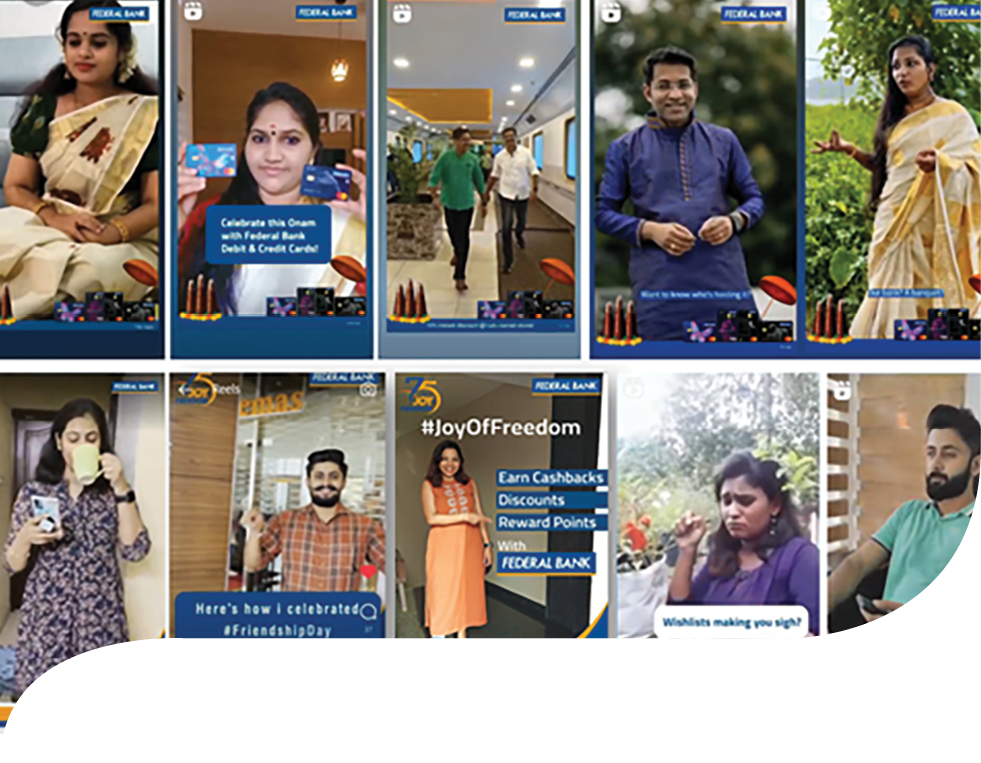

Moment Marketing

Our awareness of the latest trends, coupled with our proactive approach, has enabled us to craft relevant campaigns that effectively capitalise on emerging opportunities. Our social media marketing and influencer marketing strategies have significantly contributed to enhancing our reach and strengthening our brand presence.

Sonic Branding

MOGO is the sonic essence of the ‘Federal’ brand in musical terms. It evokes the core values, emotions and persona of the organisation. In line with this, we developed eight unique adaptations of the MOGO for various campaigns/festivals. The impact of this initiative was remarkable as the campaign created 7.6 Million impressions across social media platforms in 10 days.

Rishta to Prime Corporate Growth

At Federal Bank, client engagement has been a strategic imperative of ours and we aspire to foster client growth through innovation and collaboration. In pursuit of this goal, we have partnered with the KPMG innovation centre to offer a programme aimed at enhancing relationships with our esteemed corporate and commercial banking clients.

Our Objective

To assist clients in creating better business models and contributing to the nation’s economic growth, with the assistance of knowledge partners and top clients’ participation.

Our Approach

We have designed a programme consisting of customised workshops conducted by KPMG consultants. The idea is to enable our clients gain valuable insights into addressing market growth, exploring new product or service lines, identifying ESG and digitalisation needs, developing EV capabilities, addressing customer segments, or setting up frameworks for corporate governance.