NURTURING A GREENER FUTURE

Federal Bank's Commitment to Environmental Stewardship

The global cost of weather-related disasters has averaged USD 200 Billion per year over the past decade. The effects of climate change are now more apparent than ever, highlighting the significance of environmental risks. The urgency to shift towards a low-carbon and climate-resilient future has become increasingly evident, creating risks and opportunities for the sector. Federal Bank, as a responsible financial institution, acknowledges the importance of conducting business in an environmentally sustainable manner. Given the involvement in various economic sectors, we recognise the pivotal role that financial institutions play in driving the transition towards a sustainable future.

Federal Bank’s efforts to minimise our operational carbon footprint is focussed on the digitalisation of products and services, generation and use of renewable energy, responsible utilisation of resources and waste recycling, among others.

Through the implementation of energy efficient technologies, emission reduction strategies, and sustainable practices, we strive to lower our environmental impact. Our diligent measurement and disclosure of emissions across various scopes backs our Bank’s aim of minimising our carbon footprint. This includes direct and indirect emissions from operations and those resulting from green financing initiatives. Our Bank is also focussing on CSR activities such as planting trees and installing solar streetlamps which help reduce the carbon footprint.

4,717.4 GJ

Reduction in Energy Consumption using Electricity

824.65 GJ

Consumption of Renewable Energy

1.8 Million tCO2

Emission Saved through Green Finance Initiative

We consistently estimate our Scope 1 and Scope 2 emissions and have estimated our Scope 3 emissions for the following categories:

- Electricity consumption in vendor-operated ATMs

- Fuel usage in vehicles used by contractors for cash transfer to currency chests and ATMs

- Business travel, including those by air, four-wheeler, train, two-wheeler, auto, bus, metro, and taxi

- Employee commute to and from work

The emission calculations were made using emission factors disclosed by the Indian GHG Programme. We aim to successfully estimate and disclose our other categories of Scope 3 emissions in the future.

We have successfully installed solar rooftop plants in several of our branches and office premises, reaching a total capacity of 300KW as of March 2023. We aim to further increase this capacity to 500KW by FY 2024-25. In line with our commitment to energy efficiency, we are replacing all the CFL light fittings in our premises with energy-efficient LED lights. Additionally, we are gradually replacing the conventional AC units with Inverter type AC units that use eco-friendly low GWP gas. This upgrade will not only reduce energy consumption but also minimise emissions. Moreover, as part of our emission reduction efforts, we have committed to exclusively procure BEE star-rated equipment.

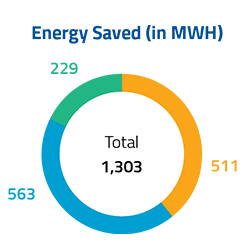

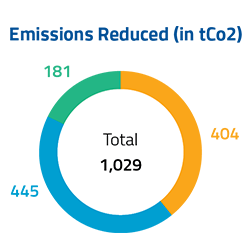

LEDification*

Shift to Invertor AC**

Grid-Connected Solar Plant

*For calculations, the transition from 6,645 traditional fluorescent lights to LED lights decreased approximately 222 kilowatts (kW) in power consumption. This estimation has been projected for a period of 12 months, assuming 8 hours of usage per day for 24 days each month.

**In this fiscal year, 1,419 Inverter/VRF AC units were installed in new and existing premises, with a capacity of approximately 2,418 TR for Inverter AC and 376 HP for VRF machines. Power savings are estimated at 12% due to the lack of a measurement mechanism, compared to the industry average of 25% savings.

By prioritising water stewardship, Federal Bank strives to preserve water resources, support communities, and lead by example in promoting sustainable business practices. We have adopted mindful architecture and have implemented water harvesting systems across select premises, effectively conserving and reusing rainwater.

As of March 2023, our Bank had successfully installed rainwater harvesting units with a capacity of 84,000 litres, resulting in an estimated conservation of 2,00,000 litres of water. Furthermore, there are plans to install additional rainwater harvesting units on more premises.

Federal Bank emphasises waste management as part of our commitment to contributing to a circular economy. We have adopted a range of strategies to minimise waste generation, encourage recycling, and promote responsible disposal practices. Aligning with our sustainability goals, we have embraced digitalisation as a pivotal factor in reducing paper consumption, optimising energy usage, and minimising emissions associated with travel.

Our focus is on minimising our environmental impact by advocating for paperless operations, reducing single-use plastics, and implementing comprehensive recycling programmes. Waste segregation bins are provided in all our branches and offices, promoting the separation of dry and wet waste at the source.

We collaborate with local authorities for effective waste collection and disposal. In line with our commitment to environmental sustainability, we engage authorised e-waste recyclers for responsible disposal.

Single-use plastic bottles have been eliminated within our premises, and we are exploring alternatives to reduce paper and plastic waste. We have started tracking plastic waste, including plastic pouches for gold ornament safekeeping. We ensure appropriate disposal in collaboration with local corporations, municipalities, and panchayats. Employee engagement initiatives like the ‘Bring Out Your Sustainability Ideas on Plastic Free Workplaces’ contest supported practical and implementable solutions. Reusable water bottles were provided to staff, promoting a reduction in single-use plastics.

Moreover, we have initiated the tracking of paper waste at our head office and plan to gradually expand this practice to other offices. We believe these proactive efforts will significantly contribute to our overall waste reduction goals.

While our operations do not directly impact biodiversity, we recognise its crucial role in our sustainability commitment. During the reporting period, we actively pursued measures to support and enhance biodiversity research, aligning with our commitment to its preservation.

We conducted a comprehensive bird census at Kazhuveli and Ossudu Sanctuaries by documenting and studying the region’s native bird species in collaboration with the Tamil Nadu Forest Department. To raise awareness, we unveiled a co-branded wall calendar featuring a diverse array of bird species from Kazhuveli Sanctuary. This calendar was officially launched by Supriya Sahu, the Additional Chief Secretary for Environment, Climate Change & Forests, underscoring our dedication to environmental preservation.

In partnership with Mathrubhumi, we have been conducting the SEED (Student Empowerment for Environmental Development) Programme to foster awareness among students and preserve the Earth’s natural resources since 2012. SEED is an initiative focussed on spreading the message of ecological conservation, encouraging schools to undertake simple yet impactful steps like planting and protecting saplings, engaging in agricultural activities, conserving biodiversity, practicing energy and water conservation, promoting cleanliness and public health, managing plastic waste through reduce, reuse, and recycle strategies, and actively intervening in local environmental issues. Till date, we have partnered with 8,432 schools and planted 9,63,929 trees through this initiative.

15,882

Trees Planted in FY 2022-23

2.90 Million

Students Partnered the SEED Initiative

Prioritising Digital. Supporting Green.

The table below outlines some of the key digital successes across the organisation and the impact they have had in the reporting period

Digital Onboarding

80% of all new onboarding

Digitalising Lending and Credit Card Origination

80% of total retail auto loans processed 100% of credit card applications processed

Fed-e-Studio-Smart Branch

Processing clearing cheques

Digital Loan Repository System

All auto loan and credit card application data/documents stored on the server

Digital Key Field Update

54% of the key field update requests being handled

Fed-e-Remit Digital Outward Remittance Platform

45% of eligible outward remittance transactions executed

Digital Document Execution

Move towards a paperless and clean working space

Digital Platforms for Investments

After introducing the SGB module in FedMobile, over 62% of the total subscriptions were received online

Certificate Issuance on Mobile Banking Platform

Feature to download/receive various certificates directly to the mobile

Fed-e-Point – Self-service Portal on Website

Over 23,26,646 service requests were received through the portal

Legality (e-Signing Portal)

In FY 2022-23, post RBI’s new Digital Lending Guidelines, 100% of the personal loan agreements were executed digitally by using Aadhar e- Sign, and ~10% of joint digital accounts were opened digitally

Transactions Done Digitally

90%

Experience Responsible Banking with Federal Bank!

At Federal Bank, we prioritise the planet’s and communities’ well-being through our comprehensive Environmental and Social Management System (ESMS) Policy. This policy serves as our guiding light to address and minimise any adverse social and environmental effects from our lending activities. The ESMS policy prescribes an exclusion list, i.e., activities prohibited for our Bank’s lending operations considering their impact on the environment and society. We emphasise supporting borrowers whose projects align with sustainable practices and contribute to improving our environment and society. We achieve this through meticulous risk categorisation of the borrowers and by ensuring that the funds lent by our Bank are used for purposes/activities which have minimal impact on the environment and society. The ESMS policy is also in alignment with the IFC Performance Standards.

Green Financing for a Sustainable Future

₹ 32.22 Billion

Green Loans Outstanding

₹ 130 Billion

Targetted Green Loans by December 2025

At Federal Bank, we actively support clients and borrowers in transitioning to a low-carbon approach through green finance loans. We prioritise energy efficient and environmentally friendly construction materials in financing green buildings. We also promote clean mobility projects, including electric vehicles, and finance renewable energy projects like solar and wind power. Recognising the importance of sustainable agriculture, Federal Bank supports climate-smart practices for reduced environmental impact and food security. We also finance projects emphasising recycling, waste management, and resource optimisation to foster the circular economy. These green financing initiatives demonstrate our Bank’s commitment to a sustainable and resilient future for all. Our green loans meet international standards through the Climate Assessment for Financial Institutions (CAFI) tool, with an estimated GHG reduction of 1.8 Million Tonnes of tCO2e.

Reducing Coal related Sub-Project Exposure to

50%

by December 2025

0%

by December 2030

At Federal Bank, we have made a deliberate effort to identify sectors that harm the environment and society, classifying them as exclusion activities. We aim to abstain from initiating any new project exposures in these sectors, particularly coal-based power plants, and coal mines, while gradually reducing the overall exposures in these areas. We have implemented a strict policy of refraining from financing any new or significant expansion to existing thermal power plants, coal mines, oil & gas exploration activities, and activities listed on the ESMS exclusion list. Through these proactive measures, our Bank demonstrates our commitment to fostering a sustainable future for both the environment and society.